USDA Loans

What are USDA Loans?

Okay, so maybe you’re wondering, “Exactly what do the USDA and home loans have to do with each other?” It’s a fair question, to be sure. In fact, USDA (or U.S. Department of Agriculture) loans are part of the Rural Development program and they offer mortgages for rural homebuyers with no down payment required (100% – 102% LTV financing based on appraised value.) Although there may possibly be financed closing costs, USDA Home Loans offer reduced monthly mortgage insurance premiums and seller concessions of up to 6% of the sales price. Also, condos may be eligible for financing – though properties need to be in a USDA-approved area.

Who Is Eligible for USDA Loans?

1

First, USDA Loans are not restricted to first time home buyers. U.S. citizenship (or permanent residency) is required, however. Additional requirements include a consistent income, usually for at least 24 months, an acceptable credit history, and a monthly payment that’s 29% or less of your monthly income (total debt payments not to exceed 41% of your income, unless you have a credit score above 680.) For those with lower – or no – credit scores, there are a few more underwriting standards or “nontraditional” references that may be utilized.

Features

Increased mortgage assistance

USDA Home Loans are an additional resource for a home loan, especially for those who may not be eligible for a traditional loan. Without VA loan eligibility, a buyer can purchase a home with $0 down.

Diverse locations

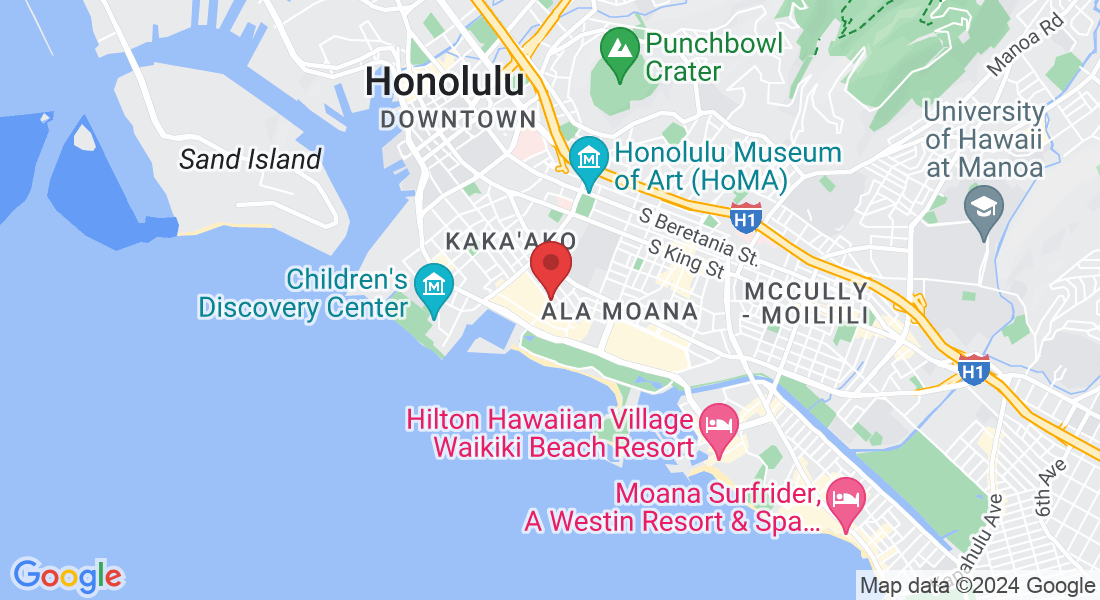

Traditionally, urban areas are excluded from the program, but some suburban areas qualify. Rural areas, however, are always eligible.